In our example, the sales revenue from one shirt is \(\$15\) and the variable cost of one shirt is \(\$10\), so the individual contribution margin is \(\$5\). This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit. Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items. In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)).

- Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future.

- Fixed costs are production costs that remain the same as production efforts increase.

- On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company.

Formula to Calculate Contribution Margin Ratio

We’ll next calculate the contribution margin and CM ratio in each of the projected periods in the final step. The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal. The higher a product’s contribution margin and contribution margin ratio, the more it adds to its overall profit. In the same case, if you sell 100 units of the product, then contributing margin on total revenue is $6,000 ($10,000-$4,000). However, when CM is expressed as a ratio or as a percentage of sales, it provides a sound alternative to the profit ratio. The contribution margin ratio represents the marginal benefit of producing one more unit.

When to Use Contribution Margin Analysis

To calculate contribution margin (CM) by product, calculate it for each product on a per-unit basis. After you’ve completed the unit contribution margin calculation, you can also determine the contribution margin by product in total dollars. For instance, you can make a pricier version of a general product if you project that it’ll better use your limited resources given your fixed and variable costs.

Calculate Total Variable Cost

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. For instance, in Year 0, we use the following formula to arrive at a contribution margin of $60.00 per unit. If the contribution margin is too low, the current price point may need to be reconsidered.

Contribution Margin vs. Gross Profit Margin

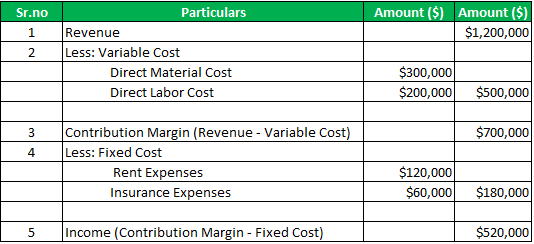

For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product. The contribution margin (CM) is the profit generated once variable costs have been deducted from revenue. Knowing how to calculate the contribution margin is an invaluable skill for managers, as using it allows for the easy computation of break-evens and target income sales. This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses. Knowing how to calculate contribution margin allows us to move on to calculating the contribution margin ratio.

Company

Therefore, the unit contribution margin (selling price per unit minus variable costs per unit) is $3.05. The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing $0.72 to profits. Contribution margin analysis also helps companies measure their operating leverage. Companies that sell products or services that generate higher profits with lower fixed and variable costs have very good operating leverage.

CM is used to measure product profitability, set selling prices, decide whether to introduce a new product, discontinue selling a specific product, or accept potential customer orders with non-standard pricing. The contribution margin represents how much revenue remains after all variable costs have been paid. It is the amount of income available for contributing to fixed costs and profit and is the foundation of a company’s break-even analysis. You may need to use the contribution margin formula for your company’s net income statements, net sales or net profit sheets, gross margin, cash flow, and other financial statements or financial ratios. In the Dobson Books Company example, the total variable costs of selling $200,000 worth of books were $80,000.

The concept of contribution margin allows you to compare the relative profitability of two different products, two different services, two different market segments, or two different distribution channels. This concept also offers a means for evaluating the effectiveness of marketing spending and pricing strategies in achieving profit objectives. Look at the contribution margin on a per-product or product-line basis, and review the profitability of each product line.

As mentioned above, the contribution margin is nothing but the sales revenue minus total variable costs. Thus, the following structure of the contribution margin income statement will help you to understand exporting cryptocurrency transactions to xero the contribution margin formula. If total fixed cost is $466,000, the selling price per unit is $8.00, and the variable cost per unit is $4.95, then the contribution margin per unit is $3.05.

Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable costs. A firm’s ability to make profits is also revealed by the P/V ratio. With a high contribution margin ratio, a firm makes greater profits when sales increase and more losses when sales decrease compared to a firm with a low ratio. In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement. When comparing the two statements, take note of what changed and what remained the same from April to May.

Fixed costs are production costs that remain the same as production efforts increase. Variable costs, on the other hand, increase with production levels. The following formula shows how to calculate contribution margin ratio.